Retiring early is not just for those born in to wealth, people with trust funds, the person that got rich from selling a tech company at 23 – all of the above, I am not. Retiring early can be achievable by most people who save more than they spend, budgets appropriately and invests their money wisely. Some of us are ahead on these and some of us are just starting out – it all takes time and the sooner we start the sooner we get to finish. I remember an old saying from my younger years that I wished I had implemented earlier on – “Do what you have to, when you have to, so you can do what you want, when you want”

I never really understood the idea of doing “what you have to”. I was always like – “Well, what do I have to do?” The simple answer is work to make money. The short answer is: make money -save money – invest money – and don’t be stupid with it. Growing up I heard concepts about money but had no real guiding help in how to figure out what to do with it. Compound interest, mutual funds, stocks, investing where as foreign to me as, well, a foreign language. What I came to realize is that either you work for money or your money works for you. There’s a good chance that if you are reading this you are not a big fan of working for money or at least don’t want to do it forever.

Making money is fairly easy – get a job. Most jobs suck or at least they are not well aligned with our purpose. We all can’t pick an awesome job that we are stoked to get up to every morning – especially when it involves a commute, working with or for somebody we don’t really like and doing something we don’t really want to do. Ask yourself this: would I show up to my job if I stopped getting paid. I’m guessing probably not. Some of us have to make ends meet because we have obligations already on the table – a family, caring for loved ones, supporting others – whatever the situation may be, it can feel like an endless loop that will never end.

All of lifes obligations and the spending of things we mostly don’t need but want keep us trapped in an endless cycle of having to go back to that job. Work in itself, is not all that bad, it is actually great when it aligns with our purpose. Take for example this blog your reading. Am I getting paid to write this? – No. Is it work? – Yes. So why am I doing it? Because part of my purpose is to help others with what I have learned. Finding your purpose, a “job” you really like is a whole lot easier once you don’t have to worry about getting paid for it. So, where do we go from here?

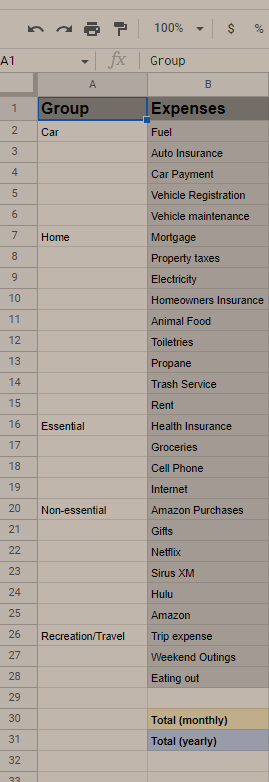

ACTION ITEM: As boring and as hard as it may be, start looking at your expenses. We all know how much money is coming in but what’s more important is what is going out. I utilize a Google docs sheet and put down every expense I have. It can be really eye opening to see where all the money is going and might make you realize (especially when you see how much a year you are spending) some items may need to be cut back on. I took a screenshot of what my spreadsheet looks like and hopefully I can create a sheet for everyone to use. For now start by putting down what you know and estimate on what you don’t. Just focus on getting an idea of your spending. This is the first step to understanding what it will take to retire early.